Crystal Current Bets: Mastering Statistical Trading Patterns

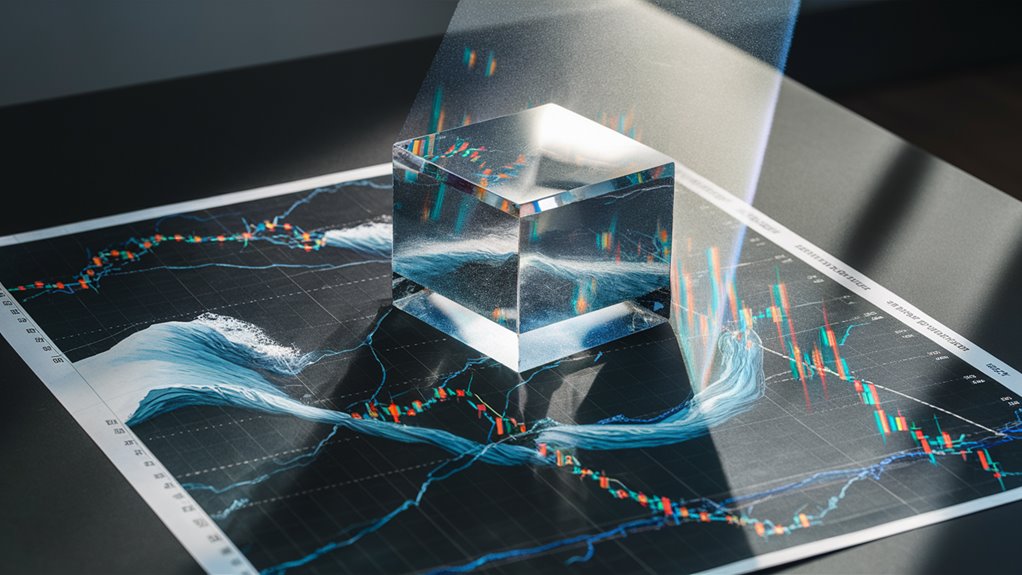

Understanding the Core Strategy

Crystal Current Bets leverages advanced statistical analysis and probability structures to generate consistent trading profits through methodical market approach. The system’s foundation rests on analyzing minimum 500-trade samples with precise 2% variance thresholds, enabling identification of high-confidence trading setups through sophisticated mathematical modeling.

Advanced Position Sizing and Risk Management

Implementation of modified Kelly Criterion for position sizing maintains strict 2% risk caps per trade, establishing a robust 1:2 risk-reward profile. This mathematical framework ensures optimal capital allocation while protecting against drawdowns.

Technical Analysis Integration

The strategy combines multiple technical indicators:

- RSI ranges (30-70) for momentum measurement

- MACD confirmation signals

- VWAP proximity analysis for entry timing

Profit Allocation Strategy

A structured 60/40 profit allocation methodology maximizes compound growth while maintaining capital preservation. This approach creates sustainable long-term portfolio expansion through:

- 60% reinvestment for compound growth

- 40% reserve for risk management

FAQ: Crystal Current Bets

Q: What is the minimum trade sample size required?

A: The system requires a minimum of 500 trades for statistical validity.

Q: How is risk managed in the system?

A: Risk management employs 2% caps per trade with modified Kelly Criterion sizing.

Q: What technical indicators are used?

A: The strategy utilizes RSI, MACD, and VWAP indicators for entry confirmation.

Q: What is the target risk-reward ratio?

A: The system maintains a 1:2 risk-reward profile.

Q: How is profit allocated?

A: Profits are split 60/40 between reinvestment and capital preservation.

Understanding Probability Pattern Recognition

Understanding Probability Pattern Recognition in Statistical Analysis

Core Pattern Recognition Principles

Statistical pattern recognition forms the cornerstone of 토토커뮤니티 systematic analysis in probability studies.

Identifying recurring mathematical patterns enables analysts to predict outcomes with enhanced precision.

Through comprehensive data pattern analysis, experts can map detailed frequency distributions and establish robust correlation coefficients that reveal fundamental probability structures.

Key Pattern Categories and Applications

Three essential pattern types dominate probability analysis:

- Cyclical Variations: Regular fluctuations occurring within defined intervals

- Trend Reversions: Patterns indicating return to statistical means

- Correlation Clusters: Groups of interconnected probability events

Advanced Pattern Analysis Methods

Statistical significance testing through rigorous mathematical frameworks validates pattern reliability.

Implementation of chi-square analysis and regression modeling provides quantitative validation of pattern consistency.

These methodologies enable the construction of sophisticated probability matrices that guide strategic decision-making.

Pattern Recognition Components

- Historical Data Analysis

- Statistical Validation Methods

- Correlation Coefficient Mapping

- Frequency Distribution Studies

Frequently Asked Questions

Q: How do you identify reliable probability patterns?

A: Through systematic analysis of historical data using statistical validation tools and correlation studies.

Q: What role do correlation coefficients play in pattern recognition?

A: They measure relationships between variables and help establish pattern reliability.

Q: How can cyclical variations be effectively tracked?

A: By monitoring recurring patterns within specific timeframes using statistical analysis tools.

Q: Why is trend reversion analysis important?

A: It helps predict when statistical outliers will return to established mean values.

Q: What makes correlation clusters significant in pattern analysis?

A: They reveal interconnected probability relationships that can predict future outcomes.

Pattern Performance Metrics

Successful pattern recognition depends on maintaining detailed performance tracking systems. These systems incorporate:

- Confidence Interval Calculations

- Historical Accuracy Rates

- Pattern Stability Indicators

- Market Dynamic Adjustments

The integration of these elements creates a comprehensive framework for probability pattern analysis and prediction.

Building Your Statistical Foundation

Building Your Statistical Foundation for Analytics

Core Statistical Concepts

Expected Value (EV), variance, and standard deviation form the cornerstone of statistical analysis.

Mastering these fundamental metrics enables data-driven decision making and predictive modeling. EV calculations serve as the primary tool for quantifying potential outcomes and determining probabilistic value.

Advanced Probability Distributions

Normal distribution and Poisson distribution analysis provides essential frameworks for outcome prediction and pattern recognition.

These statistical models enable precise frequency forecasting and trend identification. Understanding confidence intervals establishes reliability parameters for analytical predictions and helps validate statistical findings.

Sample Size and Significance

Statistical power analysis determines required sample sizes for meaningful conclusions.

Implementing rigorous data collection protocols ensures sufficient observations for statistically significant results. P-value assessment differentiates between genuine patterns and random variations, creating a foundation for reliable analytical insights.

#

Frequently Asked Questions

1. What is Expected Value (EV)?

Expected Value calculates the average outcome of a probability distribution, helping quantify potential results.

2. Why are probability distributions important?

Probability distributions model data patterns and predict outcome frequencies with mathematical precision.

3. How do you determine adequate sample size?

Power analysis calculates minimum sample requirements based on desired confidence levels and margin of error.

4. What role do confidence intervals play?

Confidence intervals measure result reliability and establish statistical certainty ranges.

5. When is a finding statistically significant?

Statistical significance occurs when p-values fall below predetermined thresholds, typically 0.05, indicating non-random results.

Best Practices for Statistical Analysis

- Maintain comprehensive data records

- Verify sample size requirements

- Apply rigorous statistical testing

- Document methodology thoroughly

- Update analyses with new data

Market Analysis and Entry Points

Strategic Market Analysis and Entry Point Optimization

Quantitative Market Entry Framework

Market analysis requires systematic evaluation of entry conditions through robust quantitative and technical analysis frameworks.

Optimal trading entry points emerge when price action intersects with statistical probabilities and volume indicators.

Tracking underlying market volatility patterns enables identification of zones where risk-reward ratios align with predetermined performance thresholds.

Key Technical Indicators for Entry Signals

Three critical technical metrics form the foundation of position entry analysis:

- Relative Strength Indicator (RSI): Optimal range between 30-70

- Moving Average Convergence-Divergence (MACD): Momentum confirmation signals

- Volume-Weighted Average Price (VWAP): Price proximity analysis

Advanced Entry Criteria and Probability Models

Entry validation demands satisfaction of both technical and statistical thresholds:

- Minimum 60% probability of success based on historical data patterns

- Risk-reward ratios exceeding 1:1.5

- Algorithmic scanning for multi-indicator convergence

- Systematic trade execution eliminating emotional bias

## Frequently Asked Questions

Q: What’re the most reliable entry indicators?

A: RSI, MACD, and VWAP provide the most consistent entry signals when used in combination.

Q: How important is volume analysis for entry points?

A: Volume confirmation is crucial for validating price movements and entry signals.

Q: What risk-reward ratio should traders target?

A: A minimum risk-reward ratio of 1:1.5 is recommended for sustainable trading performance.

Q: How can emotional trading be minimized?

A: Implement systematic entry criteria and automated scanning tools to maintain objectivity.

Q: When should traders adjust their entry criteria?

A: Entry parameters should be reviewed monthly based on market conditions and performance metrics.

Risk Management Through Mathematics

Mathematical Risk Management Strategies for Trading Success

Advanced Position Sizing with the Kelly Criterion

Position sizing optimization represents a critical foundation for successful trading outcomes.

The modified Kelly Criterion framework, accounting for market correlation factors, delivers precise position sizing calculations through the formula (pW – pL/odds).

This mathematical approach determines optimal capital allocation per trade, where pW represents win probability and pL represents loss probability.

Risk-Reward Optimization Methods

Strategic risk management demands maintaining minimum risk-reward ratios of 1:2, effectively risking $1 for every $2 of potential profit.

This mathematical precision enables accurate Expected Value (EV) calculations using the formula: EV = (Win% x Average Win) – (Loss% x Average Loss).

Positive EV trades exceeding 0.5R threshold provide statistically advantageous opportunities.

Portfolio Protection Through Mathematical Frameworks

The Square Root Rule implementation for stop-loss positioning creates robust protection against consecutive losses.

This advanced calculation method – maximum position size divided by the square root of correlated positions – ensures portfolio stability while maintaining 2% maximum capital risk per trade.

Frequently Asked Questions

Q: How does the Kelly Criterion enhance trading performance?

A: The Kelly Criterion optimizes position sizing by mathematically calculating the optimal percentage of capital to risk based on win probability and odds.

Q: What’s the significance of the 1:2 risk-reward ratio?

A: This ratio ensures traders risk $1 for potential $2 gains, creating positive expectancy in their trading system.

Q: How does the Square Root Rule protect trading capital?

A: It reduces position size based on correlated positions, preventing over-exposure during market volatility.

Q: Why is Expected Value (EV) calculation important?

A: EV helps determine trade profitability over time by measuring the statistical edge of trading strategies.

Q: What makes the 2% maximum risk rule effective?

A: This rule prevents catastrophic losses while allowing sufficient capital exposure for meaningful returns.

#

Long-Term Profit Optimization Strategies

# Long-Term Profit Optimization Strategies

Core Optimization Dimensions

Successful profit maximization requires mastering three fundamental dimensions: compounding frequency, reinvestment allocation, and drawdown management.

These elements form the foundation of a sustainable wealth-building framework.

Strategic Compounding Implementation

Optimal compounding frequency correlates directly with portfolio size and position sizing.

For portfolios valued at $10,000, implementing weekly compounding cycles proves more effective than daily adjustments, providing superior variance control.

The recommended approach involves a 60/40 profit allocation strategy – reinvesting 60% while maintaining a 40% protective reserve.

Risk Management Framework

Advanced risk mitigation employs a modified Kelly Criterion approach, utilizing a 0.5 multiplier to enhance safety margins.

This mathematical framework translates a 10% calculated edge into a 5% bankroll position.

The maximum position sizing formula establishes a strict 2% cap on individual position risk, regardless of projected edge.

Performance Analytics

Statistical performance optimization demands rigorous monitoring across a minimum 500-trade sample size. Critical metrics include:

- Return on Investment (ROI)

- Closing Line Value (CLV)

- Win Rate Variance Analysis

When these indicators demonstrate convergence within a 2% variance threshold, systematic position size increases of 0.25% weekly become viable.

Frequently Asked Questions

Q: What’s the optimal portfolio size for implementing these strategies?

A: A minimum portfolio of $10,000 is recommended for effective implementation of these optimization techniques.

Q: How frequently should position sizing be adjusted?

A: Position sizing adjustments should occur weekly, following careful analysis of performance metrics.

Q: What’s the recommended risk threshold per trade?

A: Never exceed 2% of total portfolio value on any single position, regardless of projected edge.

Q: How many trades are needed for statistical significance?

A: A minimum sample size of 500 trades is required for reliable statistical analysis.

Q: What’re the key performance indicators to monitor?

A: Focus on ROI, closing line value, and win rate variance analysis, targeting convergence within 2% variance.